Double customs and with import tax

When importing, you may require "double clearance and tax." Many foreign trade friends are not particularly clear about what is "double customs with tax included", the following is a brief introduction.

1. What is "Double Clearance"? The complete customs link of international trade is the seller's export and then the buyer's import. It involves export customs declaration and import customs clearance. Similar personnel go abroad, they will first export customs inspection and then import customs inspection. .

2. What is "tax-included"? Taxes include customs duties, value-added tax and consumption tax (collected by customs). From the above-mentioned export declaration and import declaration, the expropriation subject is divided into exporter’s customs collection and importer’s customs collection. Countries generally encourage exports. Except for some resource-consuming products that need to be controlled for export, the taxes levied by export customs are relatively small and most are not levied. The customs of the importing side is different. Import taxes are often levied to protect the development of the country. Including tax means that both export and import taxes are included.

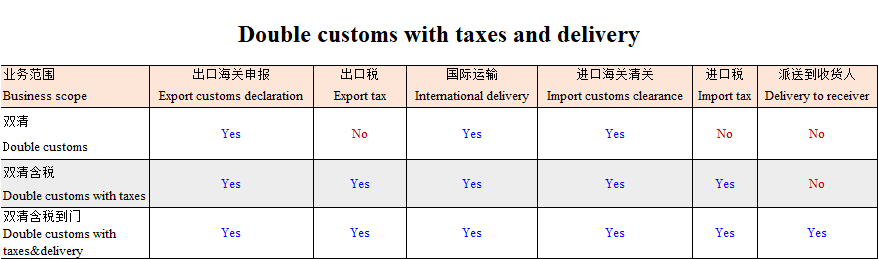

Therefore, the complete meaning of "double clearance including tax" is responsible for both export and import declarations, including export tax and import tax at the same time.

3. The difference with "Double customs". It represents export declaration and import customs clearance, which do not necessarily include import taxes, and mutual confirmation is required to avoid misunderstanding.

4.

The difference with "delivery to door". It generally refers to the

delivery to the consignee and the delivery fee is included. It is not stated in

advance that the consignee may be required to pick up the goods at the

designated place of import, or if delivery is required, the delivery fee will

be charged separately.

The above is for

reference only and the actual terms shall prevail. In addition, the customs

requires truthful declaration according to the name and value of the goods. The

following chart is the classification of the service scope and the countries

and regions that can be cleared and taxed. It is continuously updated.

Delivery to consignee with import customs taxes included to below

countries,

Philippines

DDP,Madagascar DDP,Costa Rica DDP,Tanzania DDP,Zambia DDP,Angola DDP,Ghana

DDP,Kenya DDP,Mozambique DDP,South Africa DDP,Cameroon DDP,Iraq DDP,Zimbabwe

DDP,Congo DDP,Mexico DDP,Emirate UAE DDP,Australia DDP,New Zealand

DDP,Bangladesh DDP,Burkina Faso DDP,Botswana DDP,Canada DDP,Côte d'Ivoire

DDP,Gabon DDP,Guinea DDP,Indonesia DDP,Libya DDP,Mali DDP,Malaysia DDP,Niger

DDP,Qatar DDP,Russia DDP,Saudi Arabia DDP,Sudan DDP,Singapore DDP,Senegal

DDP,Togo DDP,Thailand DDP,United Kingdom DDP,American USA DDP,VietNam

DDP,Malawi DDP

Cities: Manila/Cebu

Davao, Antananarivo/,San Jose/,Dar Es

Salaam/,Lusaka/,Luanda/,Accra/,Nairobi/,Maputo/,Johannesburg Durban Cape town/,Yaounde

Yaoundé DOUALA/,Bahdad Erbil/,Harare/,Brazzaville Kinshasa/,México Monterrey

Guadalajara Cancun/,Dubai Abu Dhabi Sharjah/,Sydney Melbourne Adelaide Brisbane

Perth/,Auckland Christchurch

Wellington/,Dhaka/,Ouagadougou/,Gaborone/,Vancouver Toronto Montreal

Calgary/,Abidjan/,Libreville/,Conakry/,Jakarta Bali Surabaya

Semarang/,Tripoli/,Bamako/,Kuala Lumpur/,Niamey/,Doha/,Moscow/,Jeddah/,Juba

Khartoum/,/,Dakar/Lome, Bangkok/,UK London Manchester Birmingham/,Los Angeles,HCM

city, Hanoi, Lilongwe.

- 上一篇:飞向巴厘岛 2021/5/13

- 下一篇:客户要双清含税, 怎么办? 2021/4/28